How 1 man caused the Bitcoin Ordinals bear market

1 person is solely responsible for causing the collapse in inscription volume during the month of October by inventing a simple tool that "sniped" BRC-20 transactions. This caused activity of new inscriptions on bitcoin ordinals to plummet. Let's dive into how he did it!

It appears 1 person is solely responsible for causing the collapse in inscription volume during the month of October by inventing a simple tool that "sniped" BRC-20 transactions. This caused activity of new inscriptions on bitcoin ordinals to plummet. Let's dive into how he did it!

Rijndael, aka rot13maxi on twitter, is already well known for making the second inscription, the famous "dickbutt #01". But he's about to be known for something else: single handedly nuking bitcoin ordinals inscription activity for an entire month. In order to understand how he did it, we have to review how BRC-20 inscriptions work:

How BRC-20s work

BRC-20 is a token standard proposed by domo that has reached over $100 million in market cap. Many have criticized how the standard works including Casey Rodarmor, the creator of Ordinals because of it's negative affects on Bitcoin's UTXO set and the token standard's ability to be frontrun.

BRC-20 tokens are issued with a "deploy" inscription that includes the token supply, max amount to mint, and ticker name. The first deploy that gets included in a block becomes the official ticker. There is no limit on how high or low the token supply can be, but most BRC-20s have common supply amounts like 21 million, 100 million, 1 trillion, etc.

Where BRC-20s are vulnerable

Because of the mechanics of "first is first" for deploying BRC-20 tokens and the public nature of most Bitcoin transactions, it was only a matter of time before someone started watching Bitcoin for BRC-20 deploy transactions and frontrunning them by issuing a deploy with a higher fee rate.

Rijndael and others had been pointing this out for months (we at OrdinalHub have discussed this publicly many times).

In general, using Bitcoin as a namespace based on block inclusion is a very vulnerable mechanism. This is widely acknowledged among people who understand blockchains but appears not to be grok'd by most people who endorse BRC-20. So Rijndael decided to demonstrate why.

The "sophon", a BRC-20 sniping bot

On October 3 Rijndael released the "sophon". The sophon is a bot that watches Bitcoin transactions for BRC-20 deploy inscriptions and then broadcasts a similar inscription for the same token ticker, but at a higher fee rate. He named it the "sophon" after a similar tool (or weapon) concepted in the science fiction book series, The Three Body Problem.

By running this bot, Rijndael was able to reliably beat other BRC-20 deploy transactions into blocks, making his BRC-20 ticker become the "official" one and the other deploy transaction(s) becoming useless. This also meant that Rijndael could choose the token supply & max mint for the ticker.

Rijndael decided to automatically set every token supply that the sophon deployed to the amount of 1. Then there would only be 1 owner of each token + ticker. This effectively stopped the token dead in it's tracks. If the original deployer wanted to launch a token or have a community mint it out, their plans were foiled as they watched their BRC-20 get frontrun. If they weren't paying attention to twitter they may have no idea what was happening.

How it created a bear market

Because Rijndael set all of the BRC-20 token supplies to 1, it meant that there was very little ability to mint the token tickers. This caused new BRC-20 mint inscription activity to plummet to nearly 0 while the bot was running.

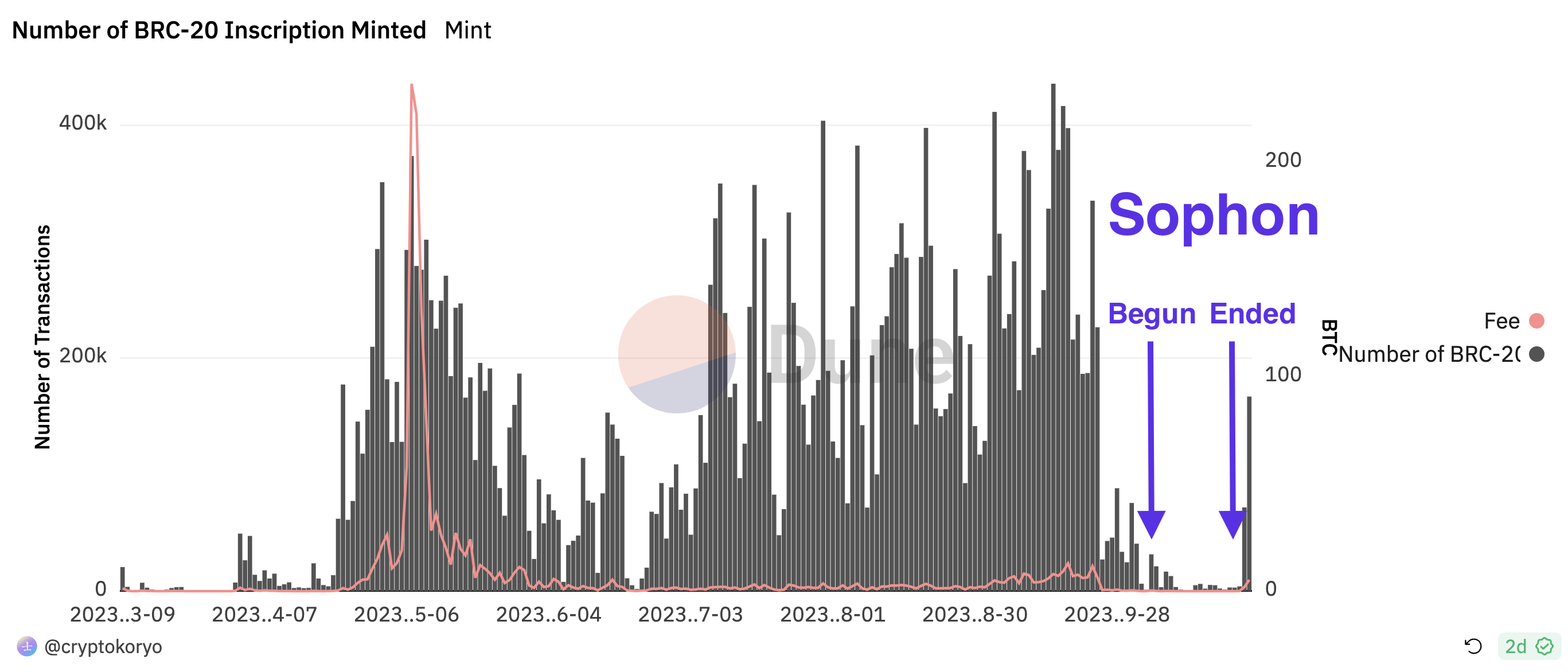

We can see this reflected in the data:

New BRC-20 related inscriptions dropped to only a handful per day as the entirety of on-chain BRC-20 activity grinded to a halt.

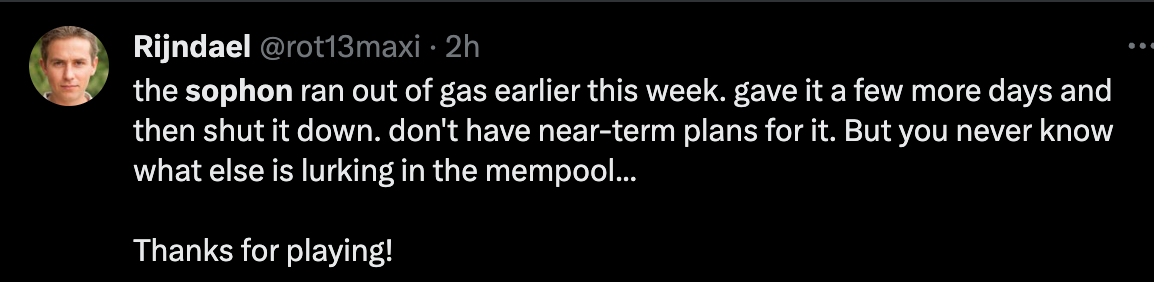

Then, a few days ago, the sophon ran out of funds to keep running and BRC-20 activity immediately shot up again.

We now have as much proof as we could want that Rijndael was single-handedly responsible for the past 20+ days of collapse in new inscription volume. Now that the sophon is no longer running, we will see what the market's real appetite is for BRC-20 and inscriptions.

The aftermath

At one point, the bot was responsible for over 5 entire pages on Unisat's BRC-20 ticker tracker. On October 17, Rijndael said that the sophon was responsible for 261 deploy transactions. Additionally he provided some data that it had a ~75% success rate in frontrunning. Rijndael has confirmed with us at OrdinalHub that the final number of deployments the sophon beat was 366.

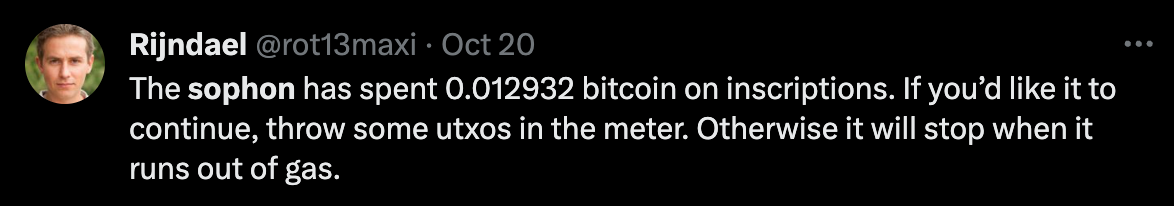

It's not cheap to run the bot – but it also wasn't that expensive in the grand scheme of things. Rijndael updated that the bot had spent 0.0129 btc since inception. That's not a lot for single handedly neutering the most popular type of Bitcoin transaction in 2023.

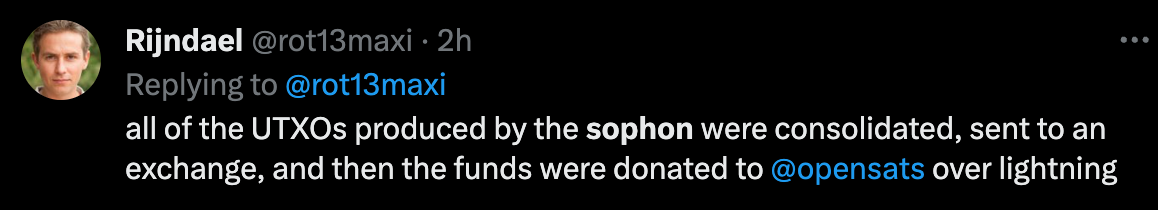

After the sophon ended, Rijndael consolidated & donated the Bitcoin in the UTXOs to opensats. We at OrdinalHub applaud his generosity and demonstration that this was not necessarily a selfish way to profit or sabotage an ecosystem, but rather an experiment and way to stress test an idea.

What's next?

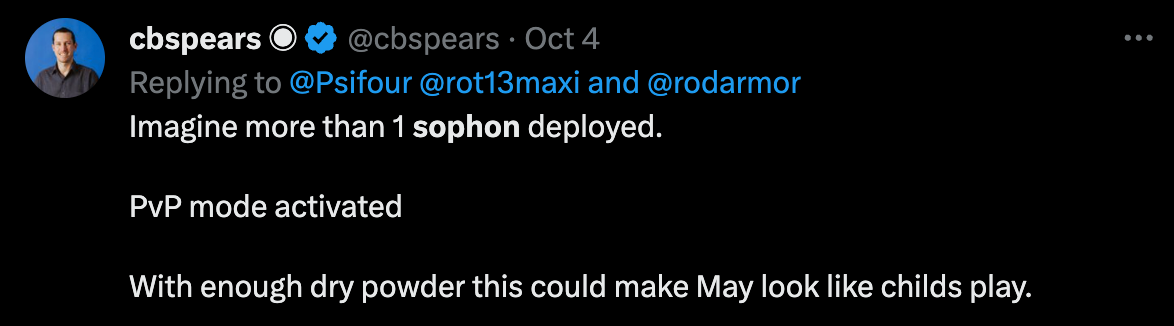

The sophon was deployed and now is ended, but that doesn't mean someone else couldn't deploy one. Also, how would we know that there isn't another sophon somewhere else currently running?

Let's imagine there are 2 sophons competing against each other – what would happen?

This brings up numerous discussions about Bitcoin miner extractible value (MEV), private mempools, and increasingly competitive block production. But those are conversations for another day.

What other beasts could be lurking in the mempool?