BRC-20 mania

"I don't know what BRC-20 is and at this point I'm too afraid to ask."

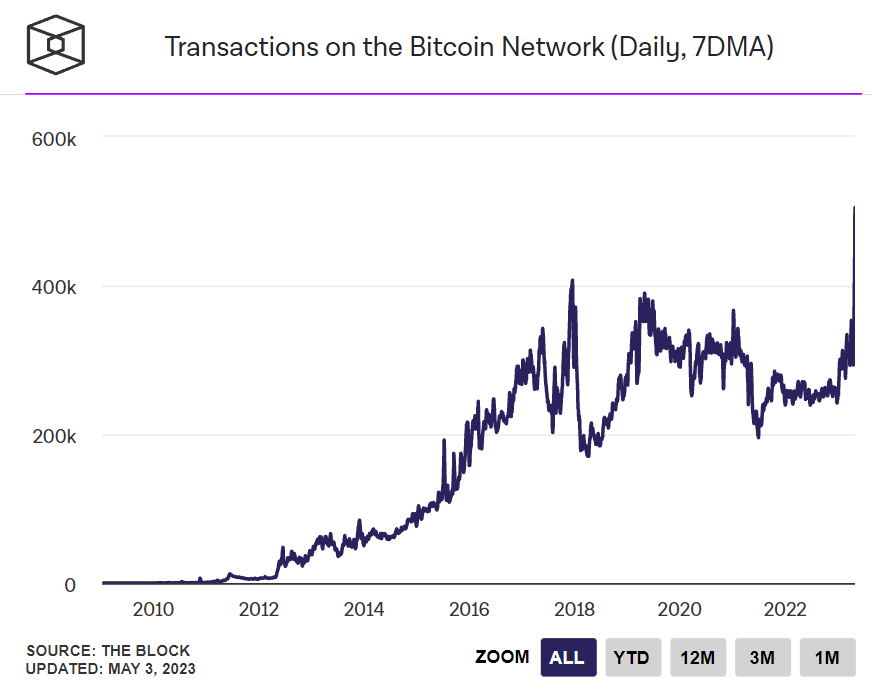

If you thought Ordinal Theory just meant JPEGs on Bitcoin you've probably been in shock the past week. BRC-20 speculators drove the Bitcoin network to new all time high daily transactions yesterday and some estimates of total market cap have already crossed $100 million. (We covered BRC-20s 2 months ago when domo launched the experiment, but it's time for a refresh). This post assumes you have/will read the disclaimers on the gitbook.

Let's catch everyone up to speed.

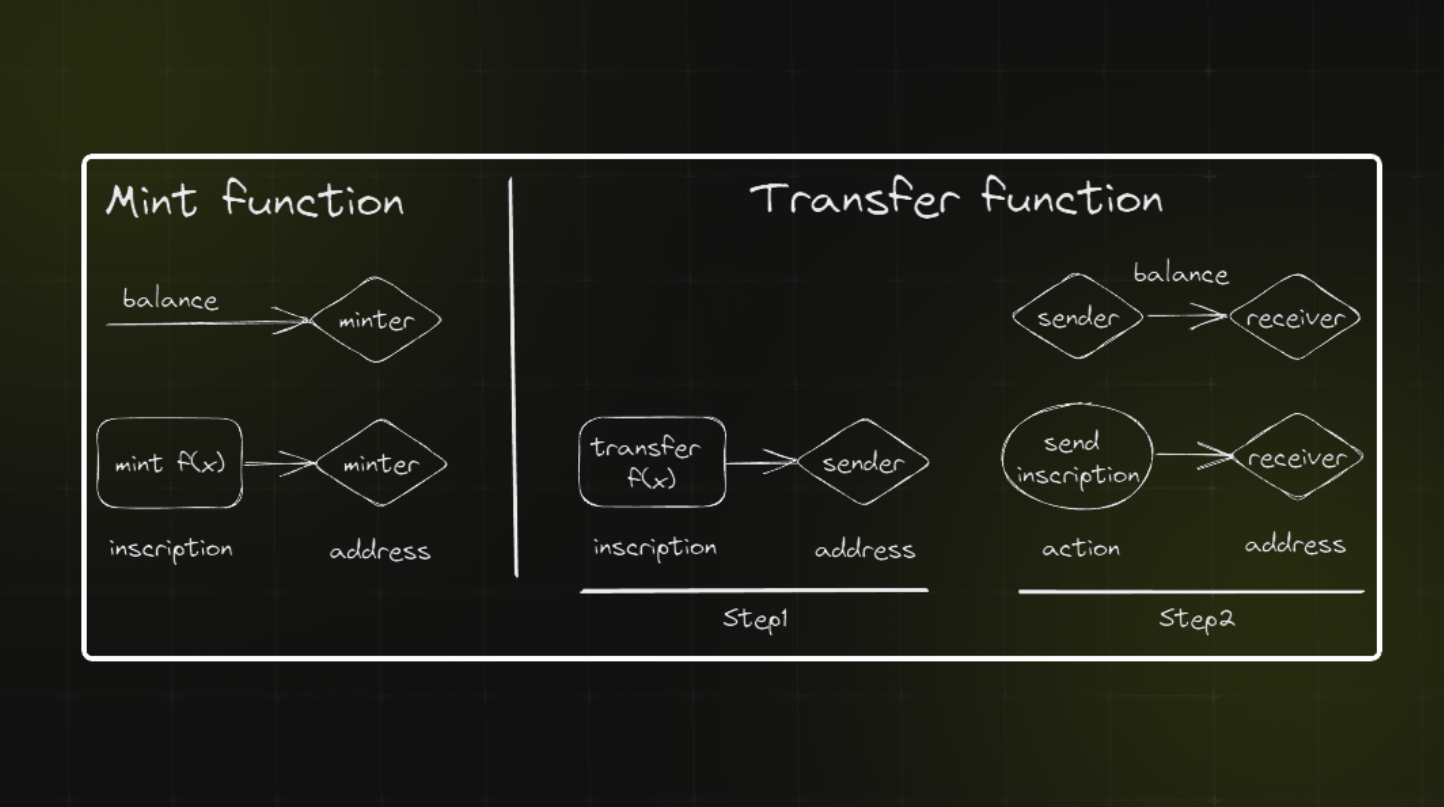

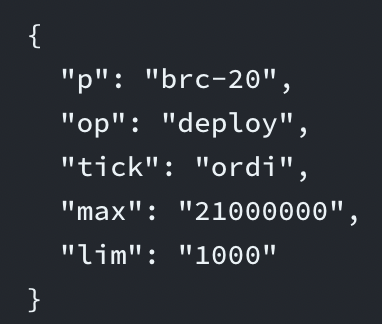

BRC-20 is an "Experiment to see if ordinal theory can facilitate fungibility on bitcoin". You can deploy, mint, and transfer token amounts through a JSON file inscription like below:

With Ordinal Theory, & Inscriptions, we can now track rudimentary token balances on Bitcoin through this standard.

BRC-20 defines ticker length as 4 characters, with minimal to no restrictions on character type. We've seen OG tickers like "ordi" (the creator's own token), "wzrd" (mavensbot, bitcoin wizards), and pepe (reference to $PEPE memecoin on Ethereum) become very popular schelling points for speculators.

When a BRC-20 ticker is deployed, anyone can "mint" the token after that, according to a maximum "limit" amount as defined by the deployment address. Some argue this creates a neutral playing field as once a token exists, it is whoever is first to inscribe. This also creates a frenzied rush to mint once a token is "hot". Some deployment contracts make the max mint limit the same as the total supply, aiming to mint the entire supply themselves shortly thereafter and sell on secondary markets or use some other distribution mechanism.

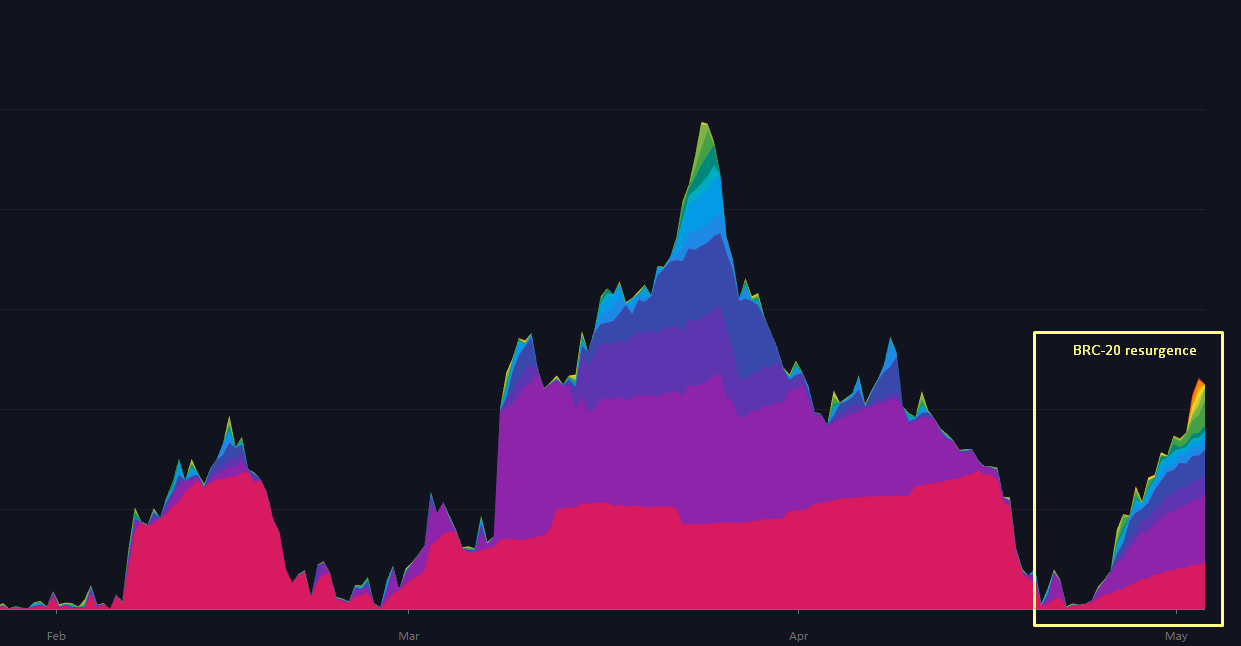

Interest around BRC-20s remained modest, with some activity picking up in early March (as referenced in our previous blogpost), and interest largely coming from Asia, due to the marketplace Unisat's early native support for inscriptions of the standard. Then in the last week or two of April, when Inscription spending slowed & the mempool finally cleared, we saw an explosive resurgence of interest in BRC-20 and Bitcoin fees skyrocket.

The 2 leading sites for tracking & trading these tokens are currently Unisat & brc-20.io. However, as far as we are aware, each site keeps track of balances & token indexes on it's own. This creates an interesting scenario where the Bitcoin blockchain nor ord client do not natively track the token balances, but rather the third party services do. Many have identified this as a significant risk to the ecosystem, especially since Unisat suffered a hack early on and raised concerns about systemic risk to third party security, indexing.

Regardless, transactions of tokens on the Bitcoin network overtook the number of regular bitcoin transactions for two days running and have led to all time high transactions on Bitcoin at the depths of a bear market.

It appears that the ecosystem is accelerating very quickly. DeFi-type "Liquidity pool" standards are popping up, mirroring the early stages of the previous crypto cycle prior to "DeFi Summer".

Here is our first draft about brc-20 LP tokens: LPv1https://t.co/HeJTjv3NbN

— Grug ◉🧙🏿♂️🔳 (@0xGrug) May 2, 2023

Take your time to digest and join our discord if you have questions/inputs and if you wanna contribute!@domodata @CrimsonElep @cbspears @OrdinallDAO @Ordinalboard @oshifinance https://t.co/rL8q6Q8uZo… pic.twitter.com/dnrnybMdQ1

🥳 Released Alpha V0.9 https://t.co/5dW82Nbab2

— nftpunk.btc (@CrimsonElep) May 3, 2023

✅️ trustless brc20 swap

🚨 utility token or pools not yet released

Beta release soon with pools and tokens, like this tweet to get updates... #BRC20 #Bitcoin

This is an ongoing & rapidly developing story, perhaps this piece will be outdated by the time you read it. We will continue to track what's happening in the Ordinals ecosystem. Subscribe to our Youtube channel to watch the Weekly Roundup every Monday to stay in the loop!